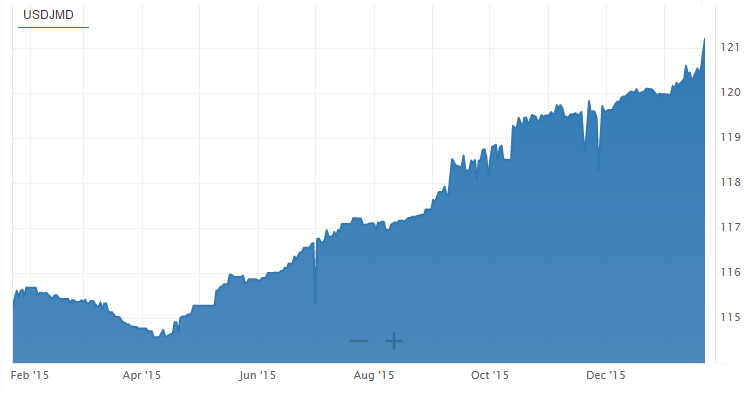

Historically, the Jamaican Dollar has depreciated an all-time low of J$121.21 against the US Dollar in January of 2016, down from $59.80 in April of 2004. The national debt is currently climbing at $2.12 Trillion Jamaican Dollars as our currency depreciates.

Did you know it’s the government of Jamaica who are devaluing our currency? By a few cents every day. This is encouraged by the International Monetary Fund (IMF); it’s apart of the US$2 billion loan deal they signed in 2013 to make Jamaican products more ‘competitive’ on the world market. Both the previous and present administrations have signed deals the IMF.

Jamaica, which became a member of the IMF in 1963, over the last three decades, has experienced very low economic growth, declining productivity, and reduced international competitiveness. An important factor behind these problems has been Jamaica’s unsustainable debt burden, which has undermined confidence and elevated risks to economic stability. Additionally, Jamaica’s high debt service has limited the government’s potential to provide the services needed to achieve sustained rates of growth, and increased welfare for its citizens. We achieved an average economic growth rate of a mere 0.8 per cent over the last 40 years.

Jamaican dollar deemed overvalued

Months before the 2013 deal, the Jamaican dollar was deemed overvalued. On March 12, 2013, the Jamaican dollar lost 12.2% of its value moving from J$97.34 to 1 US dollar to an all-time high of J$109.02 to 1 US dollar on March 12, 2014. Keep in mind that a cheaper Jamaican dollar may attract more investors and tourists but a devaluing dollar will make it harder to make payments to service our increasing US dollar debt.

JLP and PNP

After the first three years of JLP governance (September 11, 2007 to September 11, 2010) the Jamaican dollar depreciated by 22.4% (from $70.16 to $85.85, an increase of J$15.69). And after the first three years of PNP governance (January 5, 2012 to January 5, 2015) the dollar depreciated by 32.2% (from $86.70 to $114.64 an increase of $27.94)

The Jamaican Dollar depreciated (against the US$) more in 2014 than in 2012

Despite Depreciation Jamaican Dollar Still Overvalued

The US dollar gained 5.09 or 4.41 per cent against the Jamaican Dollar during the last 12 months from $115.46 in January of 2015 to J$121.21 in 2016.

Note: Last November, when the Jamaican dollar traded at $119.84 to US$1, Bank of Jamaica Governor Brian Wynter said the Jamaican dollar was no longer overvalued and was less susceptible to unpredictable slippage, following recommendations by the IMF for its continued devaluation to competitiveness of Jamaican products. The government has since announced an increase of the national minimum wage of $6,200 for a 40-hour work week on January 20, 2016 — effective on March 1, 2016 — up from 2014’s $5,600.

In December 2015, Chief Executive Officer of the Private Sector Organization of Jamaica, PSOJ, Dennis Chung, said Jamaicans should stop fretting about the depreciation in the value of the local currency against its US counterpart. He noted that the pace of depreciation will slow even further when the $62-billion owed to bond holders who participated in the National Debt Exchange, is paid February 2016.

Last week, Co-chair of the Jamaican Economic Programme Oversight Committee Richard Byles also defended the sliding of the Jamaican dollar — stating that the tight fiscal policies put in place by the IMF, along with reduction in oil prices has resulted in a 50-year low inflation rate of 3.7 per cent at the end of calendar year 2015.

“We have to say thanks to the tight fiscal policy, and very much so to oil which has played an important role in bringing inflation down. When you look at inflation for the calendar year of 3.7 per cent and devaluation of five per cent, it’s within range and you’ve heard the governor on previous occasions saying that our currency was sufficiently competitive and will not devalue anymore. I guess this is one of the factors he was referring to, why inflation was coming in much less than previously expected. That gives us a competitive gain of 1.3 per cent from the 3.7 per cent and 5 per cent,” he said at a press briefing at Sagicor’s headquarters in New Kingston.

Byles argued that the decline in inflation, in addition to the five per cent currency depreciation the country experienced last year, has positively impacted the Jamaican dollar’s competitiveness to the United States dollar by 1.3 per cent in point to point currency change.

Jamaicans and companies earning in US dollars may be happy with this decline in the value of our local currency, but it is not good for the country overall. Each time the value of our dollar depreciates it threatens the business sector in Jamaica; the cost of products and services on the island increases; the cost of living increases though inflation is said to be declining.

How Jamaicans declared war on devaluation in 1992

In 1992, months before P J Patterson won his first general election, the Jamaican currency had spiraled out of control, dropping from J$16 to US$1 to almost J$31 to US$1 almost overnight; the price of everything was literally doubling. Banking on the patriotism of Jamaicans, Gordon ‘Butch’ Stewart launched The Save-the-dollar campaign, better known as the ‘Butch’ Stewart Initiative (BSI), after the hotel mogul decided he could not sit by any longer and watch the Jamaican people being crushed under the weight of the wildly devaluing dollar.

Stewart had devised a very complex marketing plan that would encourage every patriotic Jamaican at every level of the nation to rally their support behind the revaluation of the dollar after a press conference. The dollar was at the time trading at J$31 to US$1. Each week Sandals would inject US$1 million into the foreign exchange market at a rate of J$25 to US$1. Ordinary Jamaicans chimed in and began dumping their dollars into the system as the revaluation solidified. The campaign had a serious effect on the weighted average at the Bank of Jamaica and consequently influenced the revaluation of the dollar. A landslide of goodwill pushed even the sceptics to become a part of the effort. The revaluation brought back some stability to the economy and an ease in the price spiral. Today we are still reaping the benefits of their labour. However, after the 1993 elections and a change of finance ministers, it seemed that a lot of money was printed and the dollar resumed its downhill drop.

Memorandum of Economic and Financial Policies

Accord a recent report by the IMF, the Government is committed to sharply reducing public debt, which is expected to decline to 96 percent of GDP by March 2020 and will further strengthen its debt management strategy and capacity. It states that, “This is expected to be achieved by sustained fiscal efforts, policies to bolster growth, as well as additional measures. In designing and implementing these undertakings, the Government will seek to ensure sound public sector governance and public debt management.”

The country’s potential for productivity is being actively depleted by crime, corruption, and inefficiency.

Some Jamaicans are calling for dollarization while others have been signaling for years that we should return to our colonizer — England.